The Euro (EUR), the official currency of the Eurozone—a monetary union of 19 out of the 27 European Union (EU) member states—has become one of the most important currencies globally, not only for the European Union but also in the broader context of the world economy. The adoption of the euro has fundamentally reshaped Europe’s economic landscape and has played a significant role in enhancing the economic and political integration of the region. This analysis focuses on the importance and role of the euro for the EU and the world economy, emphasizing its economic, political, and strategic significance.

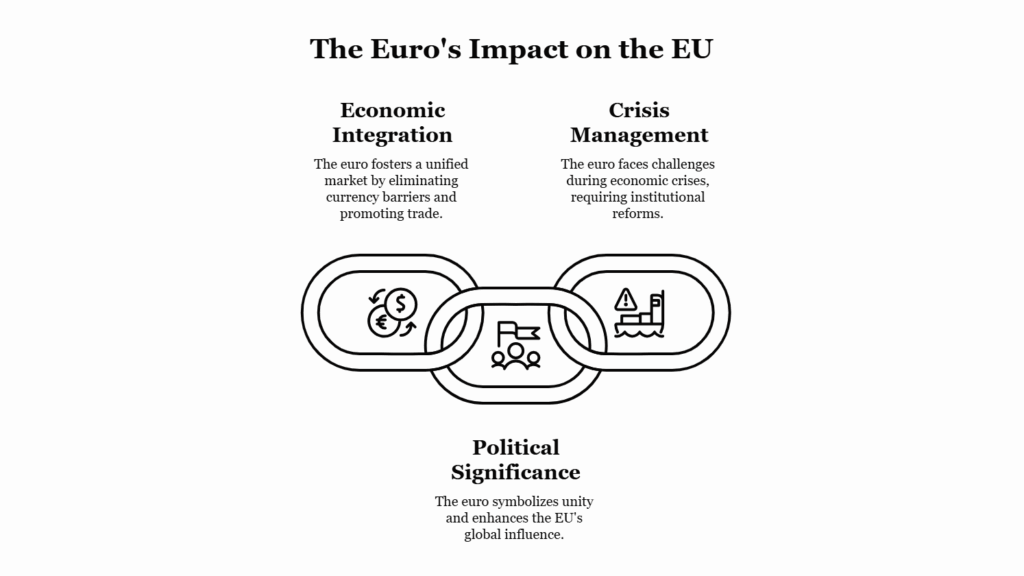

The Euro’s Role and Importance for the European Union

- Economic Integration and Stability

The introduction of the euro in 1999 marked a significant step toward deepening economic integration within the European Union. By establishing a single currency, the EU aimed to eliminate the risks and costs associated with currency fluctuations, simplify cross-border trade, and create a more integrated and cohesive market.

- Single Currency, Single Market: The euro has been crucial in the functioning of the Single European Market, enabling the free movement of goods, services, capital, and people across the member states without the need for currency conversions. The removal of exchange rate risk has encouraged trade and investment among Eurozone countries, fostering deeper economic integration and improving efficiency in the internal market.

- Price Transparency and Competition: The use of a common currency has made it easier for consumers and businesses to compare prices across member states, fostering greater competition and efficiency within the Eurozone. This has particularly benefited consumers by reducing price differences between countries, promoting better price transparency, and enhancing market efficiency.

- Stability and Economic Policy Coordination: The euro is managed by the European Central Bank (ECB), which aims to maintain price stability through its monetary policy. The Stability and Growth Pact (SGP), an agreement within the EU, sets limits on the fiscal deficits and debt levels of member states to maintain economic stability. This coordination of economic policies has aimed to prevent economic imbalances and crises within the Eurozone.

- Political and Symbolic Significance

The euro is not only an economic tool but also a symbol of the EU’s political cohesion and aspirations. Its introduction was a key step in the EU’s political integration and helped to strengthen the Union as a global actor.

- Symbol of European Unity: The euro has become a symbol of Europe’s political unity and cooperation, symbolizing the EU’s efforts to create a more integrated and harmonious region. For the citizens of the Eurozone, it represents a tangible benefit of European integration and an embodiment of shared values of cooperation and solidarity.

- Stronger Political Influence: As the Eurozone countries adopt the euro, they increase their economic ties, which enhances the EU’s collective bargaining power in international negotiations. The single currency also allows the EU to present itself as a more unified economic entity, giving it a stronger voice in international organizations such as the International Monetary Fund (IMF), the World Trade Organization (WTO), and the G20.

- Crisis Management and Economic Challenges

While the euro has provided many benefits, it has also posed significant challenges, particularly during times of economic crisis. The sovereign debt crisis in the late 2000s and early 2010s highlighted some of the vulnerabilities of a currency union that lacks a unified fiscal policy.

- Financial Instability and Austerity: Some Eurozone countries, particularly those with high levels of public debt (e.g., Greece, Spain, Portugal, and Italy), faced severe financial instability. The inability of member states to devalue their currencies in response to economic downturns (since the euro is common to all) made it difficult for these countries to adjust to fiscal imbalances, leading to austerity measures and social unrest.

- Institutional Reforms and Responses: The EU responded to these challenges by strengthening the European Stability Mechanism (ESM), which provides financial assistance to member states in economic distress, and by creating a banking union to ensure the stability of the Eurozone’s banking system. Despite these challenges, the euro has remained the currency of choice for the majority of the EU, with significant efforts made to preserve its credibility and functionality.

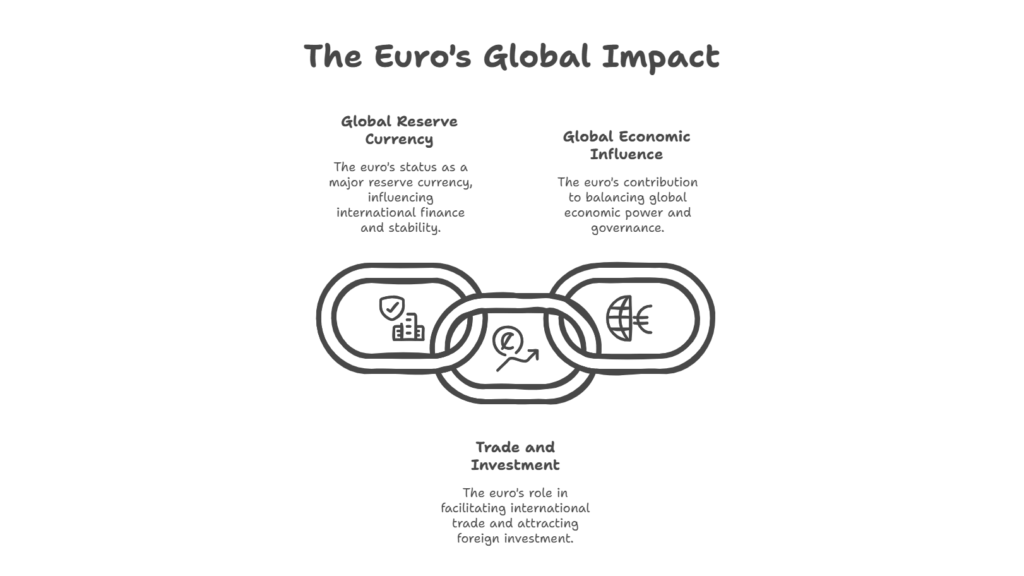

The Euro’s Role and Importance in the World Economy

- Global Reserve Currency

The euro is the second most traded and most widely held reserve currency in the world, after the US dollar. The European Central Bank (ECB) and other Eurozone central banks hold euro-denominated assets as part of their foreign exchange reserves. As of 2024, the euro accounts for approximately 20% of global foreign exchange reserves, making it a key part of the international financial system.

- Reserve Currency Status: The euro’s reserve currency status offers the EU significant advantages, including lower borrowing costs for governments and private entities, as it is easier to finance debt in a currency that is widely held and accepted internationally.

- Currency Swap Arrangements: The ECB has engaged in currency swap arrangements with major central banks, including the US Federal Reserve, which ensures liquidity in the global financial markets and provides financial stability in times of crisis. These arrangements underscore the euro’s importance as a global currency.

- Trade and Investment

The euro facilitates international trade and investment by providing a stable and predictable currency for transactions. Non-EU countries and multinational corporations also use the euro for cross-border trade and financial transactions.

- Euro as a Trade Currency: Many international commodities, including oil and gas, are priced in euros, and several emerging markets hold euro-denominated debt. The euro’s use in global trade reduces transaction costs and risks associated with exchange rate fluctuations.

- Attraction for Investment: The size and stability of the Eurozone market make it an attractive destination for foreign direct investment (FDI). Investors often prefer to deal in euros because of the market’s depth, transparency, and the economic stability offered by the EU.

- Global Economic Influence

The euro also plays a role in balancing the global economic power. The dominance of the US dollar in global trade and finance has been a source of tension in international economic relations. The euro’s role as a counterbalance to the dollar strengthens the EU’s ability to influence global economic policies and norms.

- Global Economic Governance: The euro contributes to a more multipolar global financial system, reducing the dependence on the US dollar and providing a stronger alternative in international economic governance forums. The rise of the euro has provided the EU with more leverage in shaping international trade rules and financial regulations.

Conclusion

The euro is of immense importance both for the European Union and the world economy. For the EU, it has served as a symbol of economic integration, political unity, and global influence. The euro has facilitated deeper economic ties among member states, boosted trade, and strengthened the EU’s international standing. On the global stage, the euro plays a vital role as a reserve currency, a tool for trade and investment, and a counterbalance to the US dollar. Despite challenges, including the financial crises that have tested the cohesion of the Eurozone, the euro has proven to be a resilient and indispensable element of the European Union and the global financial system.

Leave a Reply